India’s recently enacted Digital Personal Data Protection (DPDP) Act casts businesses into a realm where virtually all data handlers, including cloud providers, marketing agencies, payroll vendors, and other third-party data processors must comply with stringent consent obligations. For professionals in privacy, legal, and compliance roles, this effectively means vendor relationships are now directly subject to legal risk.

Under the DPDP, a company (as a data fiduciary) has responsibility for its vendors’ use of data, even when the vendor “misbehaves” or inadvertently fails to comply with the terms of consent. This means intentional due diligence, ironclad contracts, aggressive oversight, and a philosophical understanding that vendors are not mere service providers, but instead are extensions of the company’s data processing. If risks from third-party consent are not managed, the combined impact can be devastating in terms of fines (maximum up to ₹250 crore), along with loss of trust from customers and damage to brand.

This deep dive guide explains why third party vendors are central to DPDP compliance, maps out the data fiduciary’s duties, unpacks hidden risks (from “shadow” subcontractors to unclear contracts and cross border data flows), and lays out actionable frameworks. You’ll find vendor due diligence checklists, model data sharing clauses, audit and governance strategies, and practical tips on using Consent Management Platforms all geared to prevent consent slip ups and build transparency with users. Along the way, we highlight common pitfalls (and how to fix them) so your organization not only ticks the legal boxes but also earns your customers’ trust.

Why Every Third-Party Vendor Matters Under the DPDP Act

Under India’s new privacy law, any company that “decides how and why” to process personal data is a data fiduciary, and those that process data on its behalf are data processors. Crucially, DPDP keeps the fiduciary fully on the hook for what those processors do. Even though a company may “hire a data processor to handle personal data on its behalf through a lawful contract,” Section 8(5) of the DPDP Act makes it plain that fiduciaries are responsible for ensuring their processors follow the law. In other words, handing off data processing does not exempt the business from liability. Any data breach or consent mishap at a vendor can lead to penalties or lawsuits against the fiduciary. In fact, DPDP’s fines (up to ₹250 crore) underscore the severe damage poor vendor control can inflict on reputation and the bottom line.

This accountability is a major shift from previous Indian rules. Today, every business from e commerce and fintech to healthcare and manufacturing relies on third parties (cloud hosts, analytics tools, customer support providers, etc.). Each of those partnerships is now a vector for privacy risk. Third party missteps can amplify breaches and sidestep consent promises, so privacy officers must treat each vendor link as part of the compliance chain.

Global Vendors and Sector-Specific Rules

In practical terms, the DPDP Act’s scope applying to any processing of digitized personal data in India, domestic or foreign based if targeting Indians means that global companies using Indian vendors also face risk. Sector specific rules (for banking, insurance, etc.) often impose even tighter vendor due diligence and data localization requirements. For example, RBI rules force payment system providers to store data only in India. All of this builds one clear message: vendor consent risk is everywhere under DPDP, and it must be managed as proactively as any internal compliance task.

Data Fiduciary Duties: Enforcing Consent with Vendors

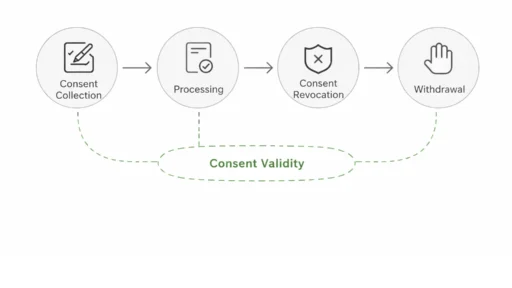

Under DPDP, “consent” is the baseline requirement for data processing: it must be “free, specific, informed, and unambiguous,” and tied to a clear purpose. Crucially, the law demands that the data fiduciary ensure all its processors honor these consent terms.

That starts with notice. Before collecting consent, the fiduciary must give the data principal a clear notice of what data is collected and why. This notice must also say how the user can withdraw consent or complain to the Data Protection Board. Once consent is given, the processing whether done in house or by vendors can only cover data necessary for that specified purpose.

In practice, that means any third party handling your data must not veer from the original consent scope. If a customer agreed to share location data to deliver a service, your CRM or analytics vendor cannot start using it for unrelated marketing that would exceed the consent, making the fiduciary non compliant. The data fiduciary must contractually bind its processors to these consent limits. Section 7 of the Act requires any data sharing contract to spell out the exact “scope, purpose, and manner” of processing. It must also require the processor to implement appropriate security and explicitly forbid any unauthorized sharing or use.

Consent Withdrawal and Managers

Withdrawal of consent triggers immediate vendor action. Under Section 6, a data principal can withdraw consent at any time with the same ease as it was given. Once withdrawn, the fiduciary shall, within a reasonable time, cease and cause its data processors to cease processing that data unless another legal ground applies. In real terms, if a customer revokes consent, you need to notify your vendors promptly and force them to purge or stop using that individual’s data. If a vendor fails to act on a withdrawal, the fiduciary risks a regulatory complaint.

Finally, the DPDP Act’s newest mechanism Consent Managers underscores this vendor theme. These are planned third party platforms where users can store preferences and grant or withdraw consent in a standardized way. Integrating your systems (and possibly vendors) with such a Consent Manager could make it easier to enforce consent across the board. While the detailed rules are still evolving, companies must architect their vendor processes to align with these user centric consent controls.

Hidden Vendor Consent Risks: Shadow IT, Transfers, and Ambiguities

Even with strong contracts, certain risks can silently undermine vendor compliance with consent.

Shadow Vendors (Fourth Parties)

Often, a vendor will subcontract to other providers. These “shadow” or fourth party processors can handle your data unbeknownst to you. Without knowing who they are, you can’t verify they respect the consent terms. A classic lapse is a vendor using a third party cloud storage or analytics service without informing you a violation of both visibility and likely data localization rules. Remediation begins with insisting (and regularly verifying) that all layers of the vendor supply chain are disclosed and governed by equivalent data processing agreements.

Cross-Border Transfers

If your vendor is outside India or sends data abroad, DPDP still applies. Currently, the Act permits transfers to anywhere except a future blacklist. But that may change, and even now fiduciaries must ensure that the data protection in the recipient jurisdiction is sufficient. Critically, if personal data (especially sensitive categories) is processed overseas, you must contractually ensure the vendor applies India’s rules even abroad. In practice, any data sharing clause should explicitly forbid transfers to unauthorized jurisdictions and require vendor compliance with government lists if/when issued. The vendor should also abide by any sectoral localization mandates.

Ambiguous or Incomplete Contracts

Vague contracts are dangerous. The DPDP mandates that data processing agreements (DPAs) be explicit about the permitted processing. For example, a DPA should precisely state the “purposes” for which the vendor can use the data, restrict it to the data categories the user consented to, and require deletion when no longer needed or consent is withdrawn. Without clarity, you may face disputes: if a vendor later claims it had broad rights to “improve services” or “legally comply,” it can bypass consent limits.

Lack of Ongoing Monitoring

Once a vendor is onboarded, you must keep an eye on them. Policies, teams, or systems change. Continuous post contractual oversight means regular audits, security reviews, compliance checks, and incident drills. Audit provisions should allow you to verify consent logs and data flows at the vendor. Too often, companies focus on the initial contract and never check if the vendor actually follows it. Other risks include insufficient staff training on vendor oversight and poor record keeping. Remedy this with clear policies and centralized records.

Example Scenario

A fintech firm finds that its marketing vendor still has email lists of customers who opted out via the website’s privacy page. The vendor assumed it could keep them for future offers. This scenario – vendor ignoring consent withdrawal can be remedied by:

(a) including an audit clause for marketing lists,

(b) running periodic checks against consent logs, and

(c) training both the vendor’s and your own marketing staff on updating their systems upon withdrawal.

Building a Vendor Consent Framework: Checklists, Clauses, and Audits

To mitigate these risks, organizations require formalized processes. Below are tangible elements that should be integrated into any vendor management program for DPDP compliance.

Vendor Due-Diligence Checklist

Before any vendor engagement, perform a rigorous evaluation. Key checklist items include:

- Legal and Compliance Standing: Confirm that the vendor understands DPDP requirements and other applicable laws. Request written assurance that they have a privacy policy and procedures that are compatible with DPDP. Determine whether the Vendor has been involved in any privacy litigation or fined. If the vendor is international, gain an understanding of the potential DPDP’s extra territorial clause implications.

- Data Security Posture: Scrutinize technical safeguards. Do they use strong encryption (at rest and in transit)? Are there access controls, multi factor authentication, intrusion detection, etc.? Ideally, request security audit reports or certifications and verify their scope.

- Sub-processor Transparency: Identify whether the vendor uses any sub processors or “fourth parties.” Get a full list of all entities that may touch your data. Conduct mini due diligence on each.

- Data Processing and Consent Practices: Ensure upstream and downstream processors collect and verify consent properly. Ask: how do they document consents? Can they handle consent withdrawal? Commit them to processing data only with valid consent.

- Data Lifecycle Policies: Check their policies on data retention and deletion. Vendors should have automated data lifecycle management. Probe how they implement this: purge schedule, backups, anonymization vs. deletion.

- Incident Response and Breach History: Inquire about past breaches and how they handled them. A vendor’s IR plan should assign clear roles, define notification timelines, and have communication plans that include you.

- Insurance and Contractual Remedies: Check if the vendor has cyber liability insurance and insist on robust indemnity clauses.

Mastering Vendor Consent Under India’s DPDP Act – From Compliance to Customer Trust

India’s DPDP Act marks the start of a new age in which every link in the data processing chain has an effect on the validity of user consent. Organizations now need to access their vendors, not as a black box, but as an accountable partner that has, at its disposal, due diligence, clarity of contracting, and continuous auditing and governance integrated into their day-to-day operations.

To effectively manage vendor consent risk is also to integrate legal obligation into business processes in a seamless way. Therefore, you should consider detailed checklist approvals for vetting and monitoring vendors, drafting model contractual clauses that impose consent limits, and conducting checks and balances using Consent Management Platforms to automate compliance. Additionally, be aware of cross border data transfer, and “invisible” subcontractors to avoid any unexpected gaps in privacy.

Above all, make consent actionable: if a user revokes permission, every vendor in your chain must promptly comply. By doing so, businesses protect themselves from regulatory fines and reputational harm while building a genuine trust advantage with customers. In the privacy age, demonstrating respect for user data and consent commitments can differentiate your brand. Don’t merely meet DPDP’s legal requirements transform vendor consent management into a culture of transparency, proactive protection, and competitive edge.