Regulatory bodies are important for determining the path of banking in an evolving financial environment. The Reserve Bank of India (RBI) has issued a crucial order. It’s part of a regulatory sandbox update. Banks are required to adhere to the outlined requirements. These requirements are specified in the Data Protection and Privacy Act (DPDPA). This move underscores the increasing importance of data security and privacy in the financial sector. In this blog, we dive into the aspects of RBI’s New Directive on DPDPA for Banks and its implications on banks and the financial ecosystem.

Understanding the DPDPA Compliance:

The DPDPA is designed to safeguard the privacy of individuals’ data and ensure responsible handling by organizations, including banks. Furthermore, as a new piece of legislation in India, the Digital Personal Data Protection Act (DPDPA) seeks to protect the privacy of personal information. Moreover, the Act represents India’s first comprehensive data protection laws. It has a clear objective: ensuring the secure and responsible handling of personal data. The Data Protection Bill is of the highest priority as it shows the data protection policy of the Indian government. Additionally, it offers significant views on the fundamental provisions integrated into the DPDPA. Thereby establishing a foundation for a more secure digital atmosphere for the population of India.

RBI’s guide to banks

“The sandbox entity must process all the data, in its possession or under its control about RSegulatory Sandbox testing, by the provisions of Digital Personal Data Protection Act, 2023.” The RBI stated in a press release dated February 28. Further added, Regulated entities under the Reserve Bank of India’s (RBI) Regulatory Sandbox framework must ensure compliance with the provisions of the Digital Personal Data Protection (DPDP) Act. Entities must implement the necessary organizational and technical safeguards to ensure successful compliance with the regulations outlined in the Act and any subsequent rules.

About RBI’s Sandbox

The RBI established the sandbox framework to enable Regulated Entities to conduct live testing of innovations in a monitored and controlled environment. Additionally, the RBI stated that the sandbox entity must implement sufficient safeguards to prevent a breach of personal data. Based on feedback from fintech, banking partners, and other stakeholders, as well as the knowledge acquired over the past four and a half years from managing four groups, the sandbox framework has been revised, according to the RBI.

The central bank has extended the duration of the Sandbox process from seven to nine months under the revised framework. Additionally, entities are now permitted to establish “in-principle partnership arrangements, if any, with various stakeholders” during the application stage for the sandbox.

How Concur Helps

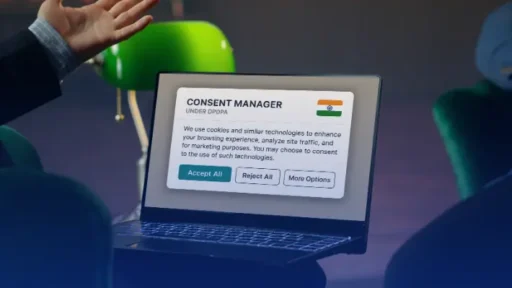

Companies encounter an ongoing challenge in the growing digital landscape: maintaining respect for data privacy regulations. The implementation of regulatory frameworks such as the DPDPA has imposed significant obligations on companies to effectively oversee and safeguard consumer data. Here comes Concur, which provides a comprehensive solution that not only improves compliance processes but also builds a sense of confidence and reliance between organizations and their customers.

By providing a comprehensive and user-friendly solution, Concur empowers organizations to effectively fulfill their privacy responsibilities. Additionally, it facilitates improved consumer relations and effectively advises on the intricacies of privacy regulations. Given the critical importance of data privacy in the current digital era, investing in Concur’s platform becomes an indispensable decision. Firstly, it preserves customer information. Secondly, it ensures compliance. Lastly, it enhances reputation in a privacy-aware market.

Final Thoughts

RBI’s new directive on DPDPA for banks marks a significant milestone. Additionally, it signifies a journey towards a secure and privacy-focused financial ecosystem. Consequently, banks adapting to these changes not only comply with legal requirements but also contribute to the development of a more secure banking environment. They also set the stage for sustained growth and customer trust. Concur provides a solution for easy DPDPA compliance. Banks and other companies using Concur can boost customer trust.